Guide for Individual Business Owners in Chengdu to Apply for Electronic General Invoices

Publish: 2024-09-10 | Modify: 2024-09-10

In the previous article "Application for the Approval and Collection of Invoices for Individual Industrial and Commercial Households in Chengdu," xiaoz shared the "Invoice Usage Application" for individual industrial and commercial households in Chengdu. This is the first step in invoicing, and once this application is approved, we can issue electronic ordinary invoices to customers.

Preface

xiaoz is not a professional financial personnel, but only compiled this article based on personal attempts, so there may be errors and omissions. The content is for reference only. If you have relevant needs, it is recommended to consult the local tax authorities or professional financial personnel. If you plan to continue reading, you need to take responsibility and risks on your own.

Issuing Electronic Invoices

Open the official website of Sichuan Electronic Taxation Bureau: https://tpass.sichuan.chinatax.gov.cn:8443/#/login, switch to the business section, and then log in by scanning the QR code using the Electronic Taxation Bureau APP or manually entering the information.

Once inside, go to I want to handle taxes >> Invoice Usage >> Blue Invoice Issuance.

Select Immediate Issuance.

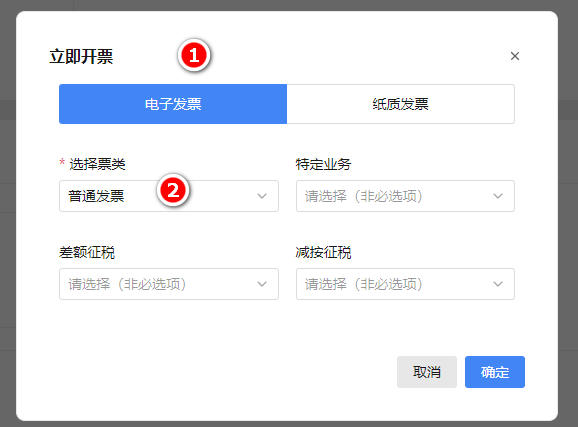

Continue to select Electronic Invoice >> Ordinary Invoice.

Then fill in the buyer information, such as company name, taxpayer identification number, etc.

Next, fill in the invoicing information, including item name and tax rate. I asked the local tax bureau for a 1% tax rate, but I don't really understand the specific reasons.

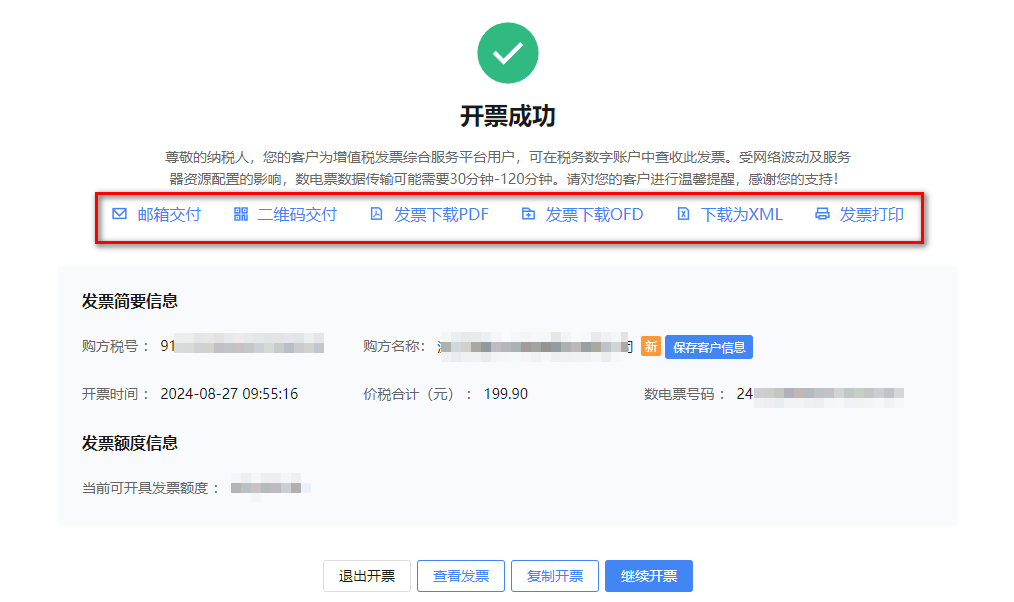

After successfully issuing the invoice according to the instructions, you can proceed with the delivery, such as downloading the PDF electronic invoice or printing it.

Conclusion

The above is the detailed process of opening an electronic ordinary invoice for individual industrial and commercial households in Chengdu, which may not be applicable to other regions. The process may change over time, so please refer to the actual situation. If you have any unclear points, it is recommended to consult the local tax authorities or professional financial personnel.

In summary:

- Choose Blue Invoice Issuance when issuing invoices.

- Choose Electronic Ordinary Invoice instead of special invoices.

- Select a tax rate of

1%.

Similarly, if you are using the Electronic Taxation Bureau APP on your mobile phone to open electronic invoices, the process and methods are similar to the web version. Please adjust according to the actual situation.

Additionally, I have set up a freelancer exchange group. If you are interested, you can add me on WeChat

xiaozmeto invite you to join the group.

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- Megalayer November Promotion: CN2 Dedicated Servers for 99 RMB/month, plus VPS Flash Sale for 9.9 RMB

- 小Z's Blog Now Fully Utilizes HTTPS

- Lemur Browser: A Mobile Browser Supporting Chrome Extensions and Free ChatGPT Conversations

- VeryCloud Cloud Distribution (CDN) Supports HTTPS, Free 50GB Traffic

- Zdir: A Practical Directory Listing Program

- Mapping Cloud Storage as Local Disk with RaiDrive

- Mounting COS to Tencent Cloud Server Using COS-Fuse Tool

- Upgrading Kernel and Enabling BBR on Linode CentOS 7

- Powerful and user-friendly PHP integrated development environment Laragon

- Another PHP Directory Lister Tool