Comprehensive Guide to Opening an Account and Applying for a Debit Card at OCBC Singapore

Publish: 2023-07-16 | Modify: 2024-07-21

Recently, Oversea-Chinese Banking Corporation Limited (OCBC) in Singapore has allowed foreign customers from China, Hong Kong, Malaysia, and Indonesia to open fully digital bank accounts locally. If you need a bank account and debit card in Singapore, you can apply for one. Due to some pitfalls encountered during the account opening process, xiaoz has written this article. Please note that this article is for reference only and does not assume any corresponding risks. If you are unable to bear the corresponding risks, please stop reading immediately..

What Are the Uses of Applying for an OCBC Account?

- Obtain 2 or more Singapore bank accounts

- Conduct cross-border payments more conveniently

- Purchase Hong Kong stocks, US stocks (refer to: Changqiao Securities, Yingli Securities)

- Apply for a debit card for online and global purchases

- Debit card supports Apple Pay/Google Pay mobile payments

- OCBC offers instant deposits for WSIE

If you do not have the above needs or do not understand the purpose of this account, I suggest you not to apply. If you have the above needs or understand the purpose of this account, please continue reading.

About Oversea-Chinese Banking Corporation Limited (OCBC) in Singapore

OCBC is one of the three major local banks in Singapore, headquartered in Singapore, established in 1932, and is one of the oldest banks in Singapore's history. The website and app support Chinese and have Chinese customer service.

Applying for an OCBC Account

First, you need to prepare the following documents/materials:

- Android or Apple phone with NFC support

- Passport

- Identification card

- Mainland China mobile number

- Prepare 1000 SGD for deposit verification

First, go to the Apple or Google store and search for "OCBC Digital" for installation, or directly visit the following links:

- Google Play: https://play.google.com/store/apps/details?id=com.ocbc.mobile

- App Store: https://apps.apple.com/app/ocbc-digital-mobile-banking/id292506828

Open "OCBC Digital" and fill in the information truthfully as required by the interface. Enter the invitation code: UZ48FDOS. Using this code and depositing 1000 SGD within 30 days will give you an additional 15 SGD bonus. The application process generally takes a few minutes to complete, with some users being instantly approved and others triggering manual review, which takes up to 7 working days. During the account opening process, remember the following information:

- You will be asked to set a username, which is used to log in to the web version. Please remember this username.

- You will be asked to set a 6-digit PIN (required for logging into the web version). Please remember this PIN.

- You will be asked to bind your phone with OneToken (a secure two-factor authentication tool).

Note: During the verification process, do not exit the current user status in "OCBC Digital," as this may prevent you from logging in after approval, leading to a loop.

After approval, you will be automatically provided with 2 Singapore bank accounts:

- Statement Savings Account (STS)

- Global Savings Account (GSA)

These accounts can be used for receiving payments or making external transfers.

Activating OCBC by Depositing Funds

After successfully opening the account, you need to activate OCBC by depositing funds into an account of the same name. As of 2023-10, OCBC has tightened its verification process and no longer supports using WISE for initial fund activation. Without account activation, all deposits will be rejected. The available activation methods collected so far are:

Bank of China

- Download "BOC Cross-border GO," new users will receive a cross-border remittance coupon

- Exchange RMB for SGD through the app

- Make a cross-border remittance to OCBC's

STS accountthrough the app. The coupon can offset handling and telegraphic fees, but there is a transfer fee of30 SGD.

Reminder: If you registered with the invitation code (UZ48FDOS) for OCBC, depositing 1000 SGD into OCBC within 30 days will earn you a 15 SGD reward (usually credited within 24H after successful remittance). Therefore, when remitting from Bank of China, considering the transfer fee, it is recommended to remit 1050 SGD.

Industrial and Commercial Bank of China (ICBC)

When making a cross-border remittance from ICBC to OCBC, a space is automatically added in the middle of the name, causing OCBC not to recognize it. Therefore, ICBC is only suitable for users with names consisting of 2 Chinese characters; it is not recommended for users with more than 3 Chinese characters in their names.

For specific operating methods, please refer to: Real Experience Sharing of Industrial and Commercial Bank of China Remitting to Oversea-Chinese Banking Corporation Limited in Singapore

Other Notes

If more than a month passes without using the same-name account for a transfer activation, you may receive a reminder email from OCBC to activate it. Prolonged inactivity may lead to account closure.

Depositing Funds to Your OCBC Account

Once you have activated the account by depositing funds into the same-name account, subsequent deposits to OCBC no longer require a same-name account. You can deposit funds into OCBC through the following methods.

Panda Remit

xiaoz used Panda Remit to remit funds to the OCBC STS account (Note: Panda Remit does not require a same-name account), and the funds were credited within minutes on weekdays.

- Panda Remit Registration Link (Invitation Code:

10947138): https://pandaremit.kcbebank.com.cn/h5activity/jcRemit?invtCode=10947138&targetLocation=ip

Panda Remit Registration and Verification Process:

- Enter your phone number, which is recommended to match the phone number of your domestic bank card.

- Provide identification card and video verification.

- Bind a domestic bank card for cross-border remittance.

Next, use Panda Remit to deposit funds into the OCBC STS account. Enter the recipient account information as follows:

- Name: Your name in Pinyin, for example, if your name is Zhang San, enter: SAN (Note: Use the name you used when opening the OCBC account)

- Surname: For example, if your name is Zhang San, enter: ZHANG (Note: Use the surname you used when opening the OCBC account)

- Nationality: China

- Receiving Bank: OVERSEA-CHINESE BANKING CORPORATION LIMITED

- Bank Account Number: The number you see on your STS account in "OCBC Digital" (Note: Do not include hyphens)

- Street and Door Number: 63 Chulia Street #10-00, OCBC Centre East, Singapore 049514

- Purpose of Remittance: Other

Ensure that the recipient's information matches the details provided by OCBC and double-check carefully. Then, enter the remittance amount (in SGD), follow the prompts to complete the payment using your domestic bank card. For weekday remittances, the funds are usually credited to OCBC instantly. Here is an example of my fee information (for reference only):

- Remittance Amount: 5292.73 CNY

- Remittance Fee: 80.00 CNY

- Total Payment: 5572.73 CNY

- Actual Receipt by OCBC: 1020 SGD

Panda Remit charges a one-time fee of 80 CNY, which is acceptable, but they also apply some exchange rate differences.

If you successfully deposit over 1000 SGD into your OCBC account (requires a same-name account), you will receive a 15 SGD bonus within a few hours (this bonus is not credited instantly).

WISE Deposit to OCBC

With an activated OCBC account, you can transfer SGD to your OCBC account using WISE or through the PayNow payment method, with no fees, and the funds are usually credited instantly.

Updating Your OCBC Mailing Address (Optional)

When applying for an OCBC account, you have already provided your residential address, which the app automatically translates into English for you. If the address is incorrect, you can modify it using the following method. If the address is correct or you do not need to apply for a debit card, you can skip this step.

OCBC Web Login Link: https://internet.ocbc.com/internet-banking/

Upon logging into the web version, you will be asked to provide:

- Access Code: The name you set when opening the account

- PIN: The 6-digit PIN you set when opening the account

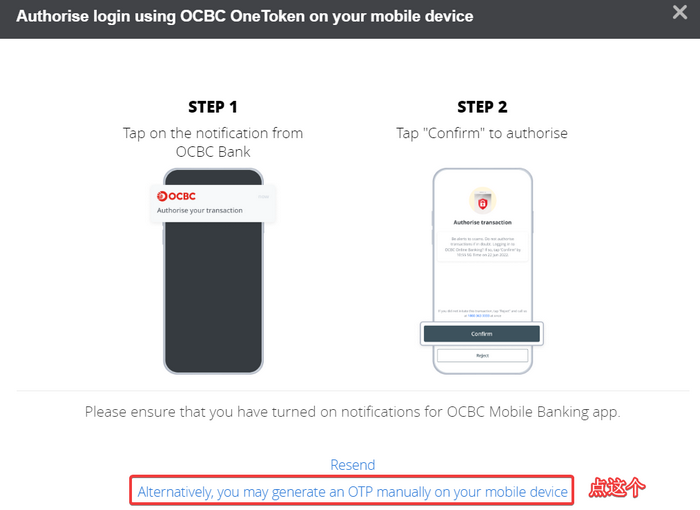

This will trigger a secondary verification called "OneToken." As you may not receive this notification due to a high probability of network issues in China, you can click on "Alternatively, you may generate an OTP manually on your mobile device."

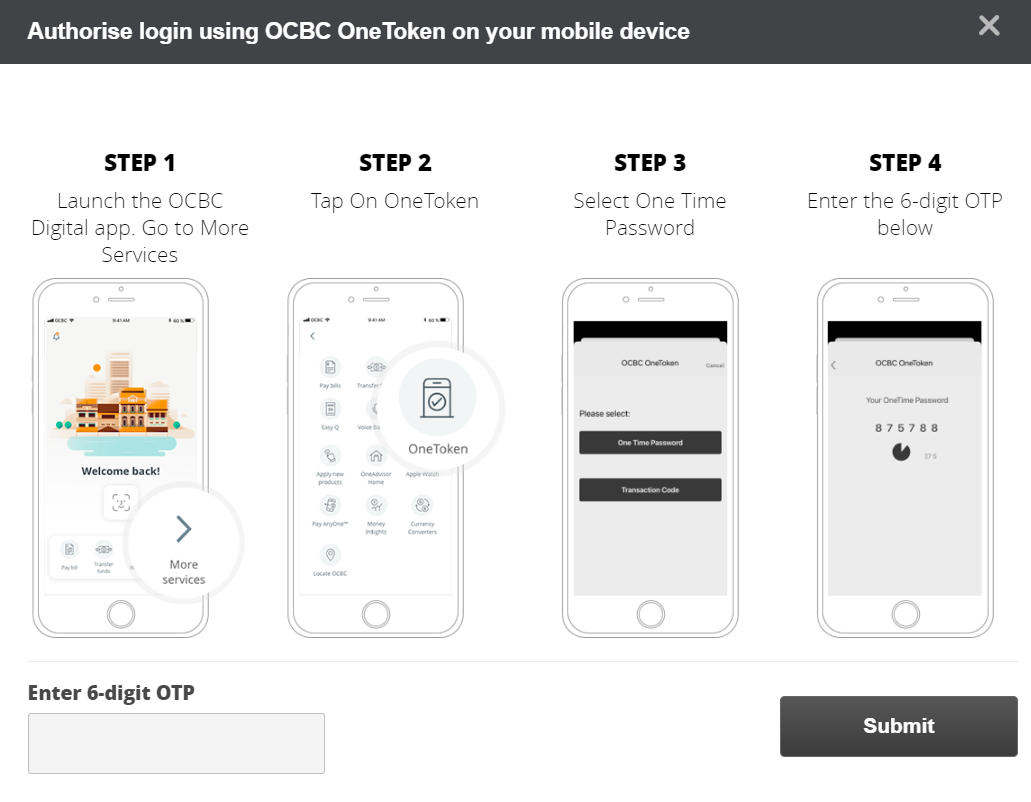

Next, open the "OCBC Digital" app, do not immediately verify your fingerprint to enter the app, click on "More" at the bottom right, find "OneToken," get the 6-digit verification code, and enter it on the webpage to log in.

I have set the OCBC web version to Chinese, click on "Customer Service - Change Mailing Address" in the navigation bar.

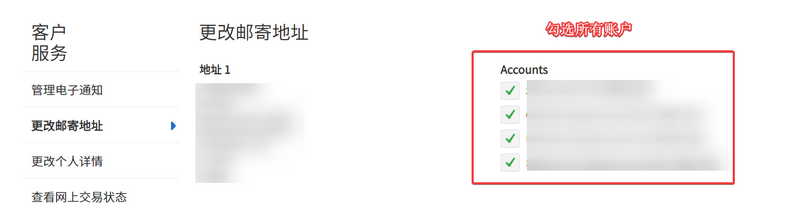

Select all your accounts, then proceed to the next page.

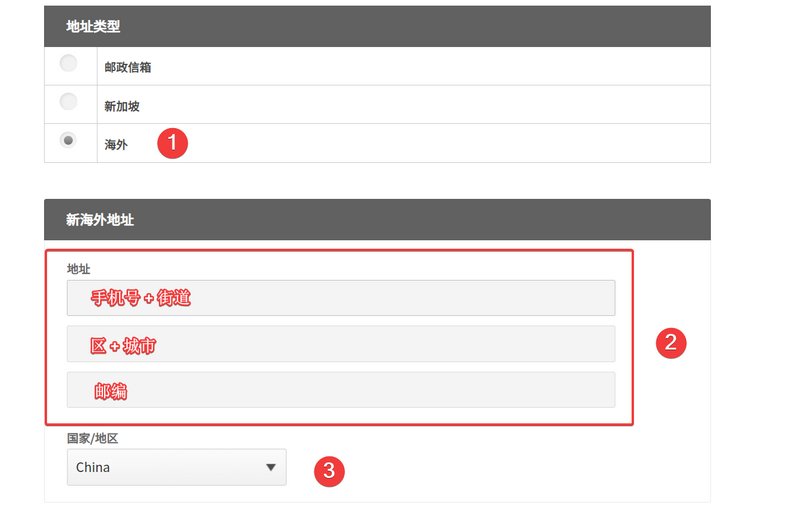

Next, enter the new address information:

- Address Type: Overseas

- Address Line 1: Enter your phone number, street address (translated by ChatGPT)

- Address Line 2: Enter your district, city (you can use Pinyin)

- Address Line 3: Enter the postal code of your address

- Country/Region: China

Proceed to the next page, save and confirm the address. Including your phone number in Address Line 1 is to ensure that the courier may not print your phone number on the logistics information, which could lead to difficulties in contacting you.

Applying for an OCBC 360 Account

Applying for an OCBC 360 Account allows you to open an additional account and automatically assigns a VISA debit card. This debit card can be used for overseas expenses (e.g., paying for ChatGPT Plus), ATM withdrawals, etc. If you do not need a debit card, you can skip this step.

Go back to the "OCBC Digital" app, click on the left navigation bar "Apply - Accounts - 360 Account," and follow the prompts to fill in the information.

Note:

- When applying for a 360 Account, it is not recommended to select self-employment (which may trigger manual review).

- It is advisable to keep the default name (otherwise, it may trigger manual review).

If manual review is triggered, you may end up with an account but no card. In such cases, you need to refer to another method to resolve this: https://blog.xiaoz.org/archives/20041

The debit card is sent by registered mail by default. You can request the logistics tracking number by going to "More Services" on the left navigation bar of the app, then "Send English Mail."

Domestic Spending

- Users who have applied for a 360 debit card can use it for card payments or ATM withdrawals in China (with fees, not recommended).

- Update "OCBC Digital" to the latest version to scan merchant UnionPay codes for payments or use Alipay QR codes for transactions.

The blogger tested using Alipay QR codes for transactions, with no fees but a 2% exchange loss. This method is suitable for emergency use but not recommended for large expenses.

About Management Fees

- Statement Savings Account: First year is free, from the second year, a monthly fee of 10 SGD is charged if the deposit is less than 20000 SGD.

- 360 Account: First year is free, from the second year, a monthly fee of 2 SGD is charged if the deposit is less than 3000 SGD.

- MSA Account: First year is free, from the second year, a monthly fee of 2 SGD is charged if the deposit is less than 500 SGD.

- GSA Account: Currently understood to have no management fees.

Conclusion

- Users from mainland China can apply for a Singapore OCBC bank account using "OCBC Digital." Using the invitation code:

UZ48FDOScan earn a 15 SGD bonus (requires a single remittance of over 1000 SGD within 30 days). - Initial activation requires a same-name account. It is recommended to use Bank of China or Industrial and Commercial Bank of China (only suitable for users with names consisting of 2 Chinese characters).

- After activating the OCBC account, you can use Panda Remit to deposit funds into the OCBC STS account. Panda Remit invitation code:

10947138. - If you need to apply for an OCBC debit card, you must first modify the address on the website and then apply for a 360 Account. When applying for a 360 Account, do not select self-employment.

- OCBC accounts are generally fee-free in the first year. If you do not meet the minimum deposit requirements after a year, management fees will be charged.

If you have any other questions, feel free to leave a comment for discussion and avoid pitfalls together.

TG Card Exchange Group, welcome to join for discussions: https://t.me/usecardone

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- A Quick Guide to OneNav: An Open Source and Free Bookmark (Navigation) Management Program

- ImgURL Image Hosting Updated to v2.2, Added API Support

- Recommend a private photo album software suitable for NAS deployment: MT Photos

- Free 1-Year Trial of Amazon AWS Cloud Services

- Multi-functional File Sharing Program Zdir 4.0.3 Update: Music Mode and Windows Version Return

- Alipay, WeChat Pay, QQ Pay: All-in-One QR Code Payment Solution

- The 2nd Year of Freelancing: Sharing Personal Project Experiences in 2023

- Intelligent Parsing + Nginx Reverse Proxy, Self-built CDN Acceleration Node

- Available Front-end Libraries in China and Zdir's Self-built Front-end Library

- Installing MinDoc Documentation System on CentOS 7