Guide to UK Corporate Tax: How to Register and Activate Your UTR

Publish: 2024-04-28 | Modify: 2024-04-28

Following the previous article "About Registering a Company in the UK," xiaoz received a "Corporation Tax Company Unique Taxpayer Reference" (UTR) from Her Majesty's Revenue and Customs (HMRC) about a week after registering the UK company. This number is commonly referred to as UTR. Newly established companies need to inform HMRC of their corporation tax collection status within 3 months of commencing or recommencing business activities, and register for corporation tax.

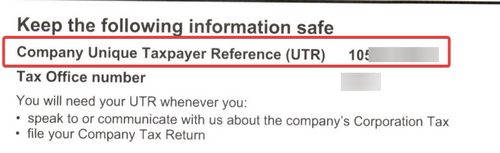

Receiving the UTR Number

xiaoz, who registered the 1st UK company, received the UTR number from HMRC approximately 2 weeks after the company registration was completed. The PDF was scanned and forwarded to xiaoz, containing the unique UTR number.

Reminder: If you did not register the 1st company, make sure the company address is correct and able to receive mail!!! If you used a Taobao agent for registration, be sure to ask for the UTR number!!!

Is it Necessary to Register for Corporation Tax?

From the documents received from HMRC, it is clear that "you need to send us certain information within 3 months of starting or restarting any business activities so that we know the company is within the scope of corporation tax collection." Once your company starts business activities (such as trading, providing services, earning interest, or other forms of income), you need to report to HMRC and register for corporation tax within three months of these activities commencing. This way, HMRC will know that your company needs to be included in the corporation tax collection scope.

If you fail to register within this 3-month period, your company may face fines or other legal consequences. Therefore, it is crucial to complete this registration promptly after commencing business activities. So, if your company is engaged in business activities, registering for corporation tax is essential.

In summary, if your company was registered successfully on January 1st but only started business activities on May 1st, you must apply for the UTR by August 1st. If the company is not engaging in business activities for an extended period, it is recommended to declare it as dormant to avoid potential issues.

Registering for Corporation Tax (UTR)

Next, I will demonstrate how to register and activate corporation tax. There are many images involved, so if you don't understand, it is recommended to use translation software.

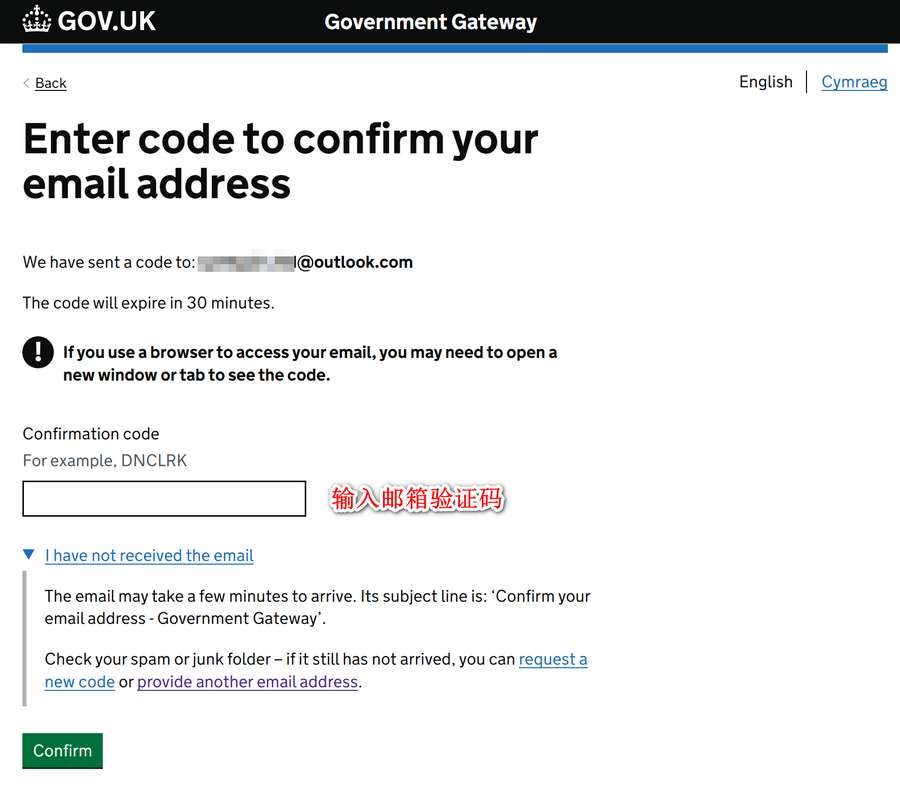

Registration link: https://www.access.service.gov.uk/registration/email

Enter your email and input the email verification code.

Click on "Continue" to proceed.

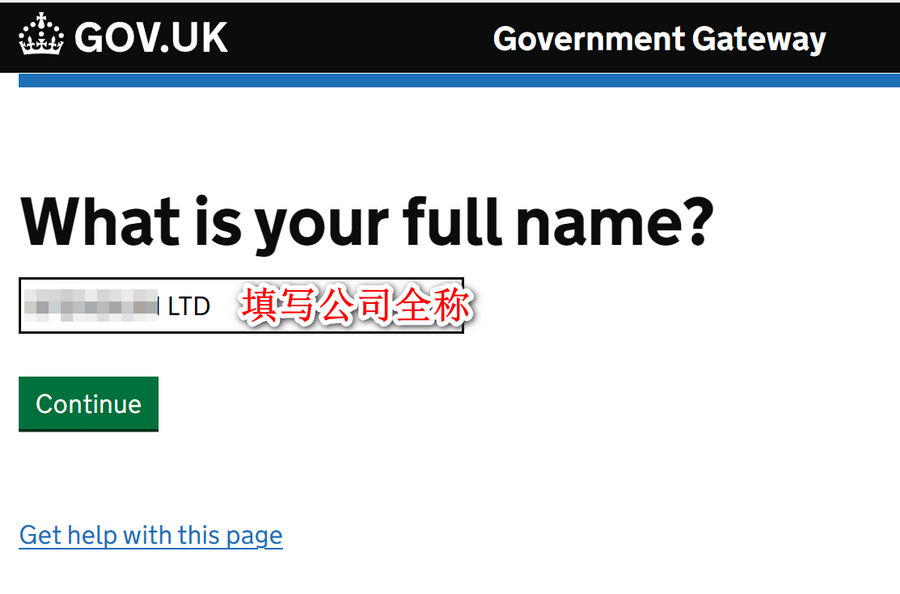

Then, fill in the full company name, note that it should be the company name, not the shareholder's name.

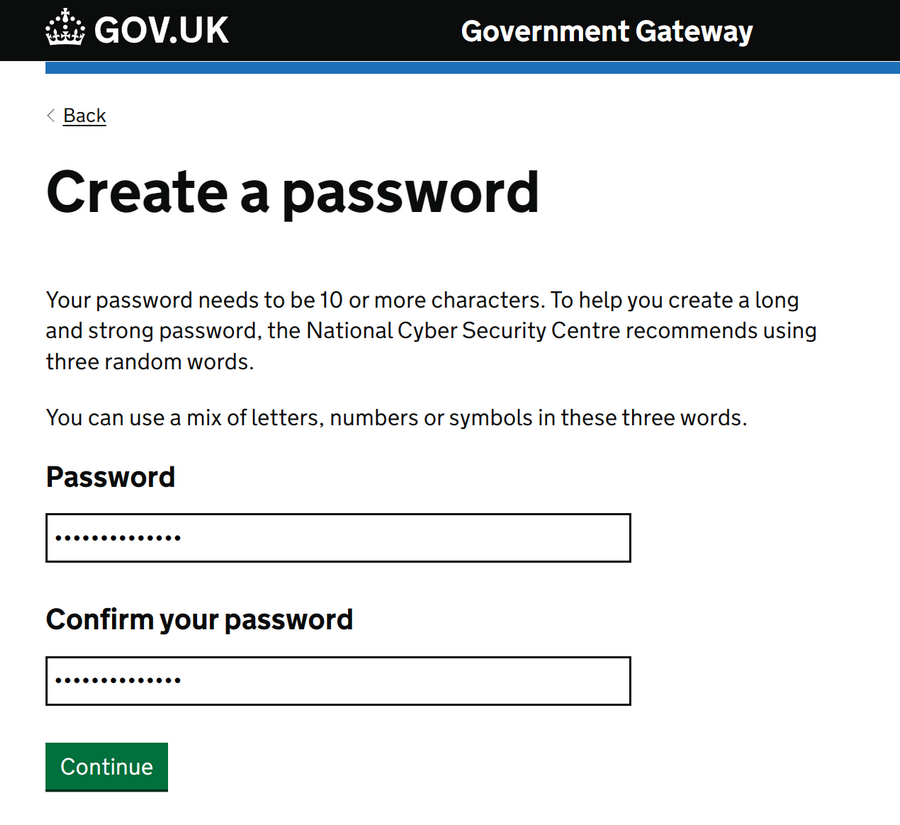

Set a login password and save it.

At this point, you will receive a login ID (also sent to your registered email), which needs to be noted down for future logins.

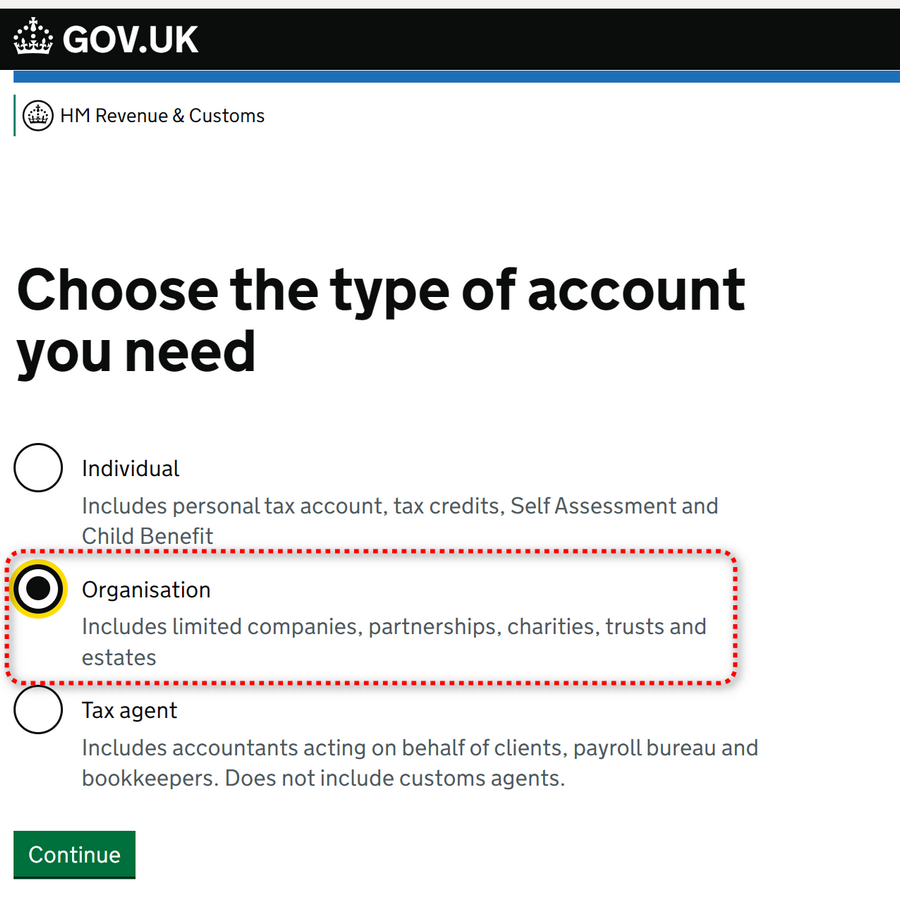

Select "Organisation" as the account type.

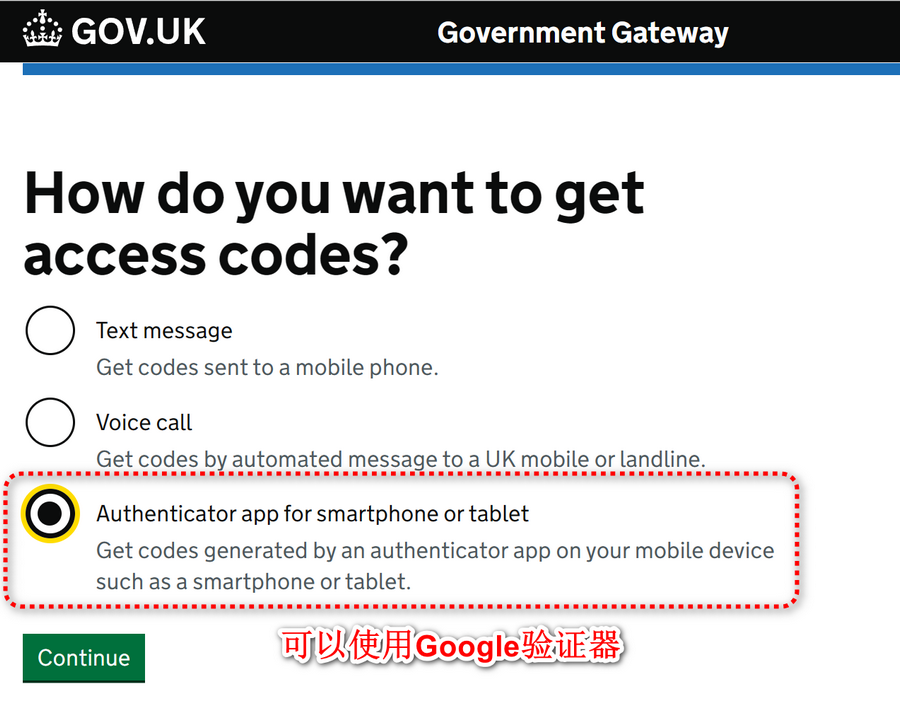

For security reasons, you will be asked to set up two-factor authentication, click "Continue" to proceed.

I chose the third option, which allows the use of Google Authenticator (the first option is SMS verification).

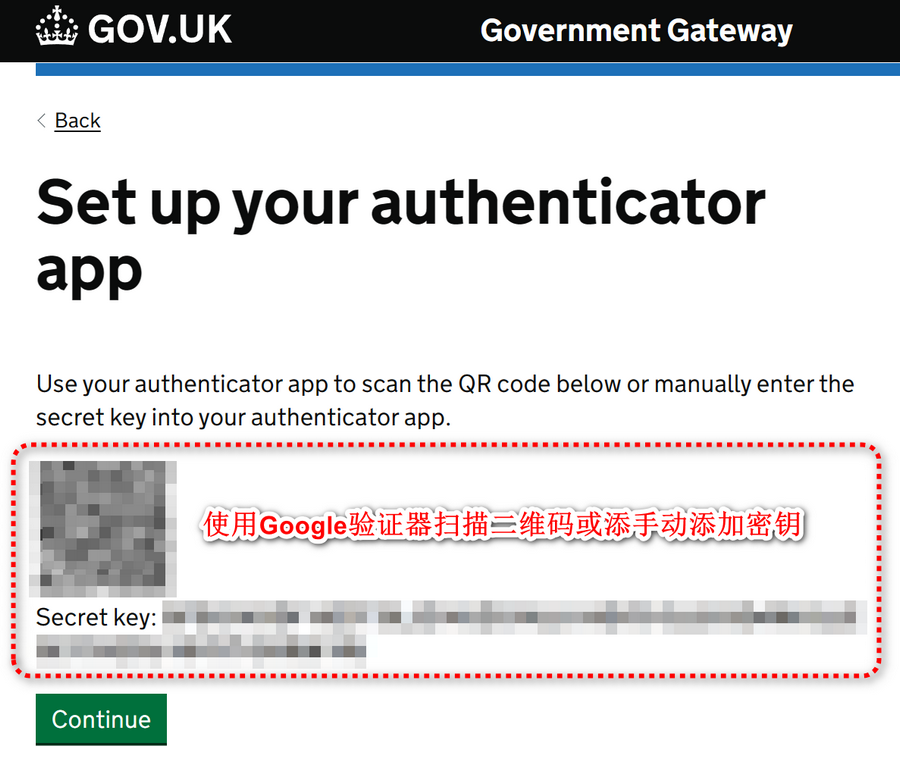

Scan the QR code with Google Authenticator or manually input the key to add it.

Enter the verification code from Google Authenticator to confirm.

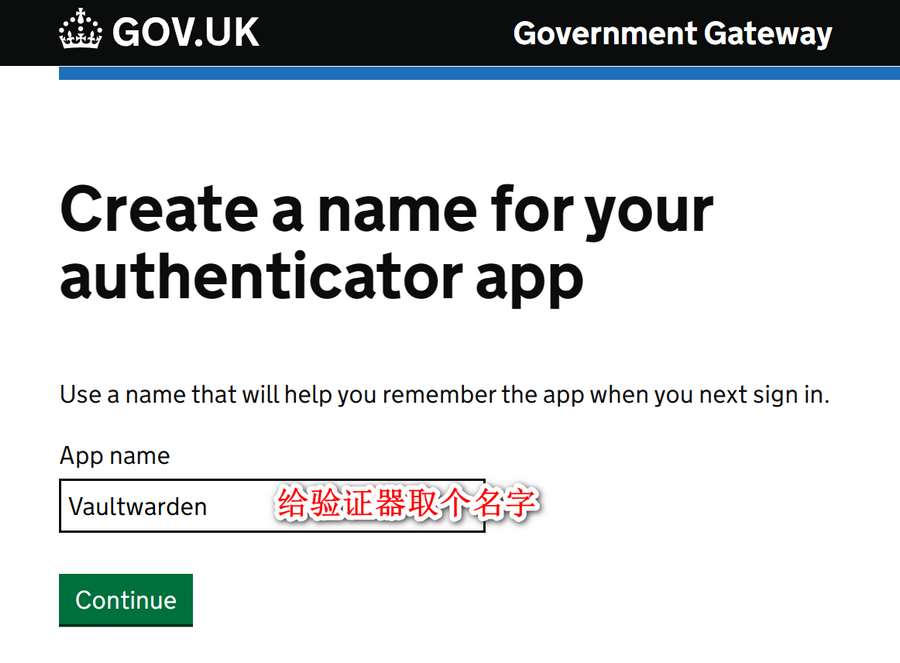

Give a name to the authenticator for easy recognition and memory.

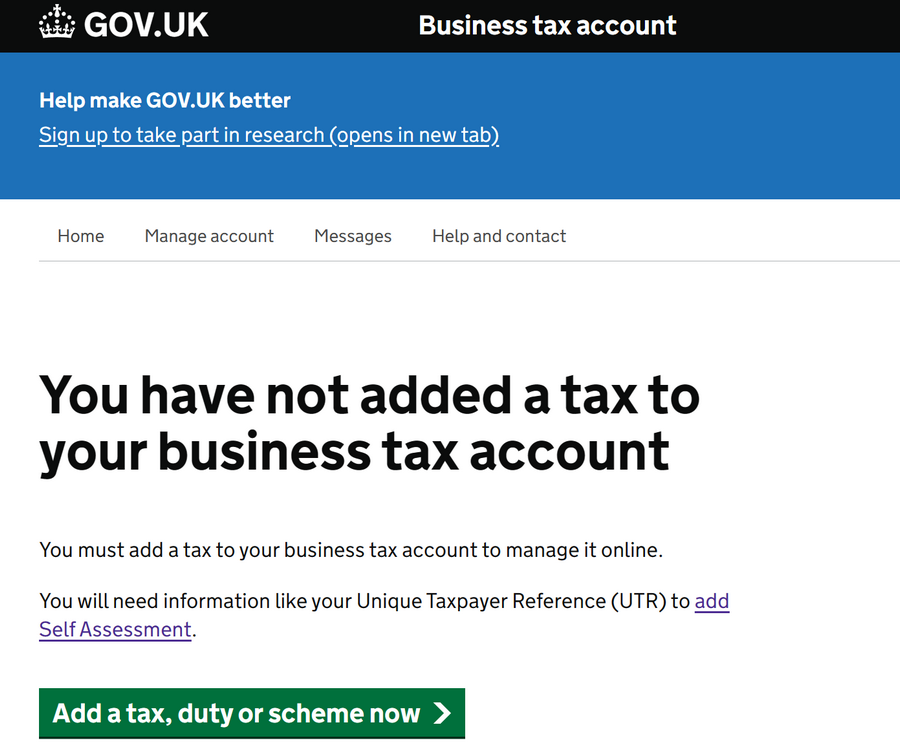

Click on the "Add tax" button to continue.

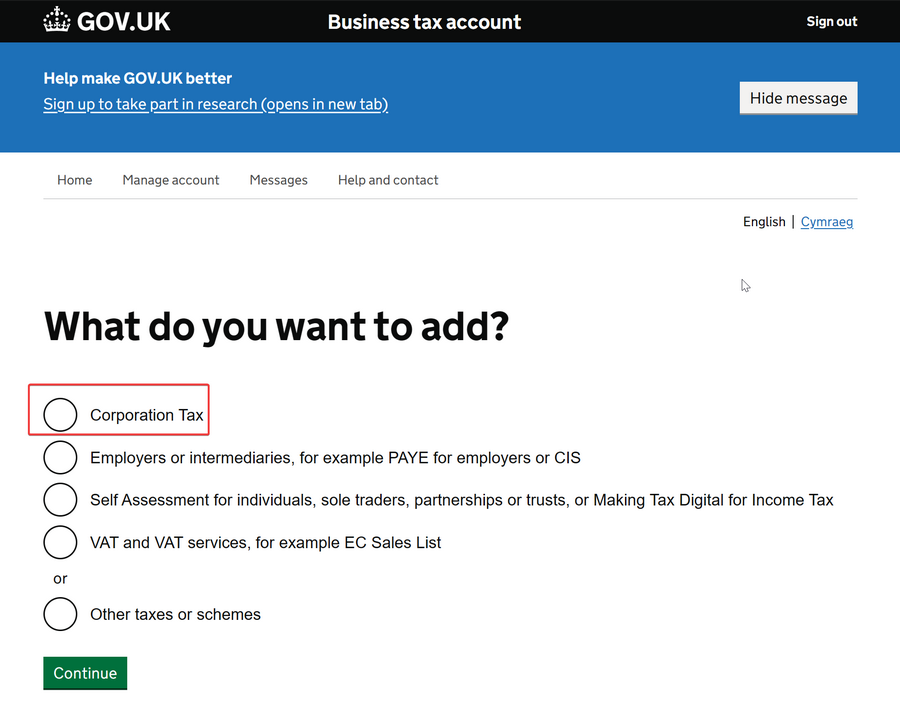

Select "Corporation Tax."

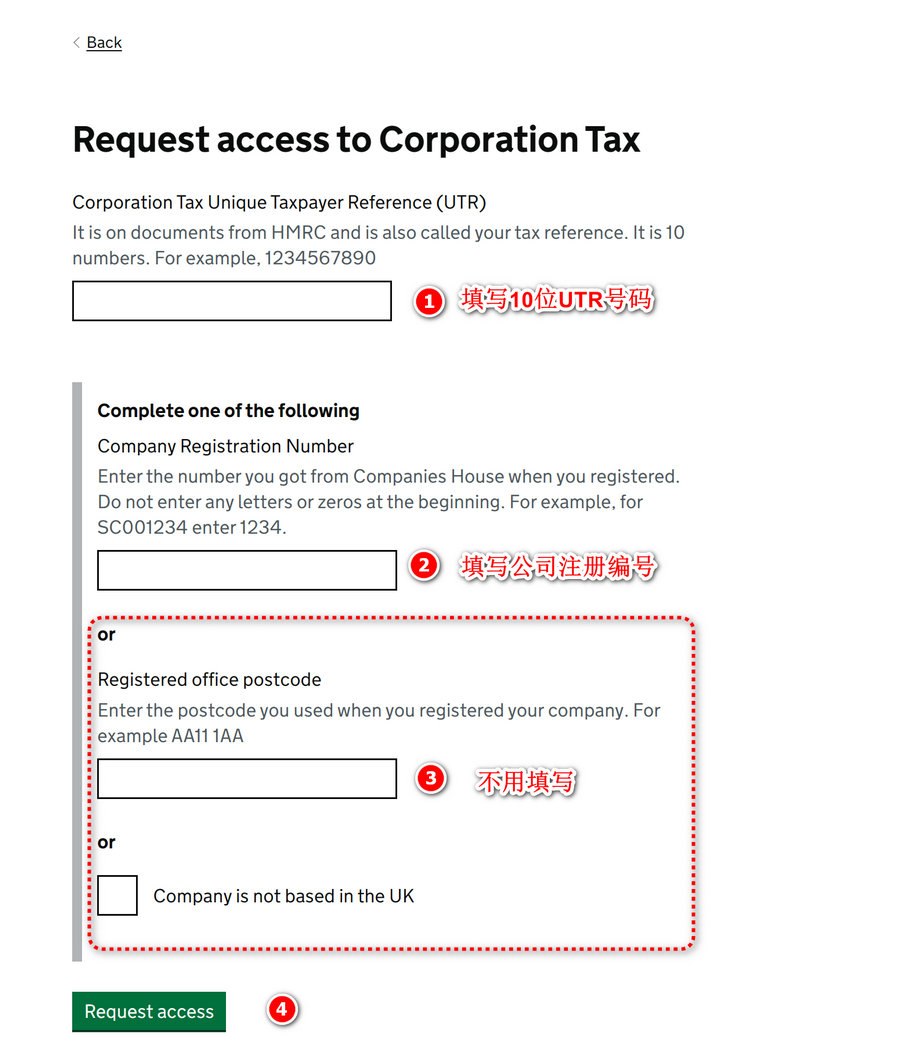

Then, enter the 10-digit UTR number and company registration number.

- For the UTR number, refer to the Receiving the UTR Number section above.

- For the company registration number, you can go to: https://find-and-update.company-information.service.gov.uk/ and enter your company name to search.

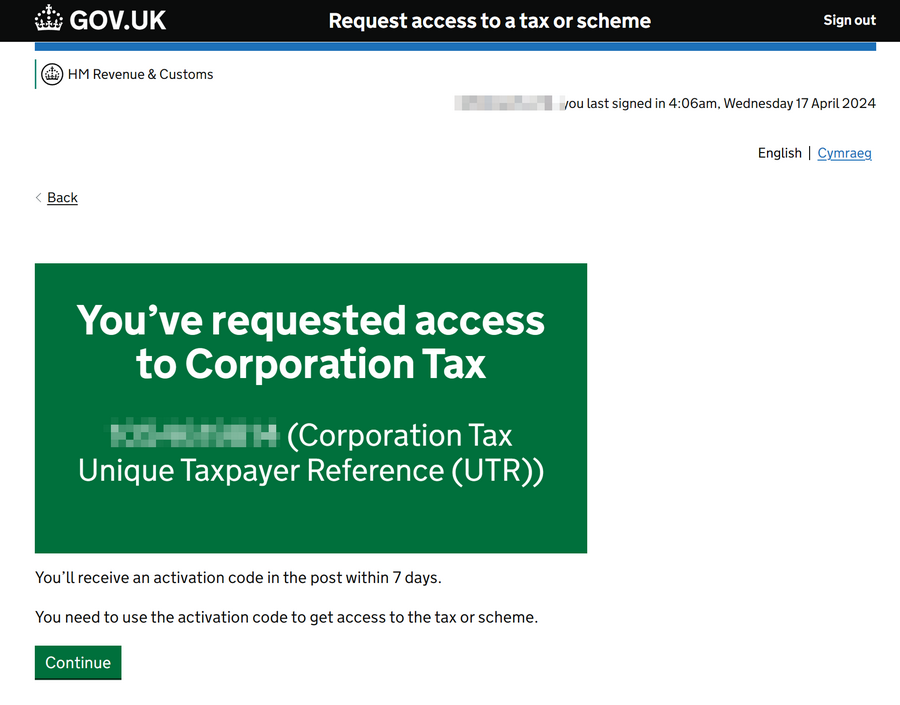

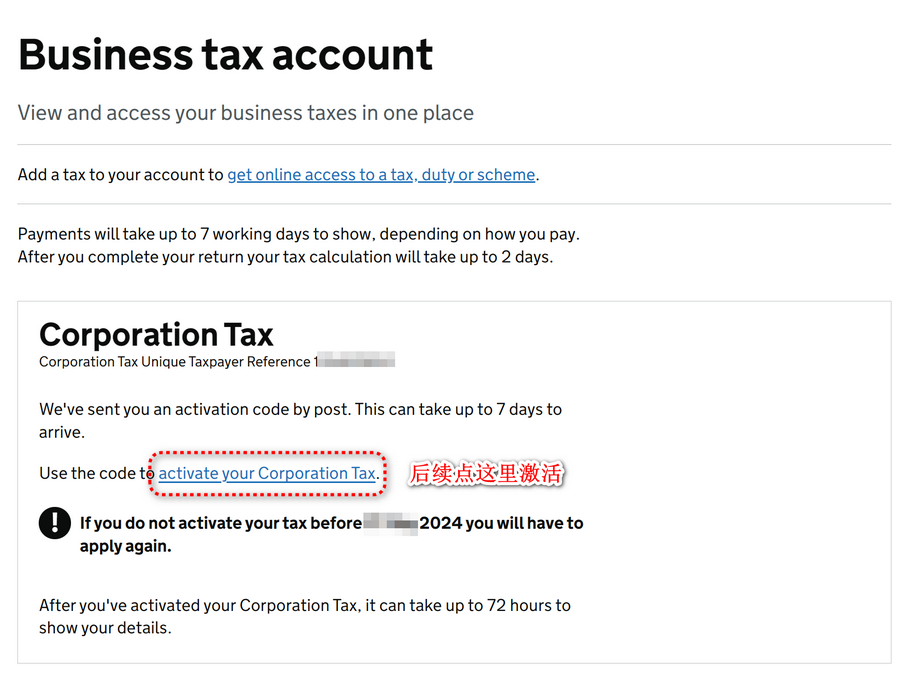

You will receive a registration confirmation, informing you that an activation code will be sent to you within 7 days.

Then, you will see a prompt to wait for activation.

Activating Corporation Tax

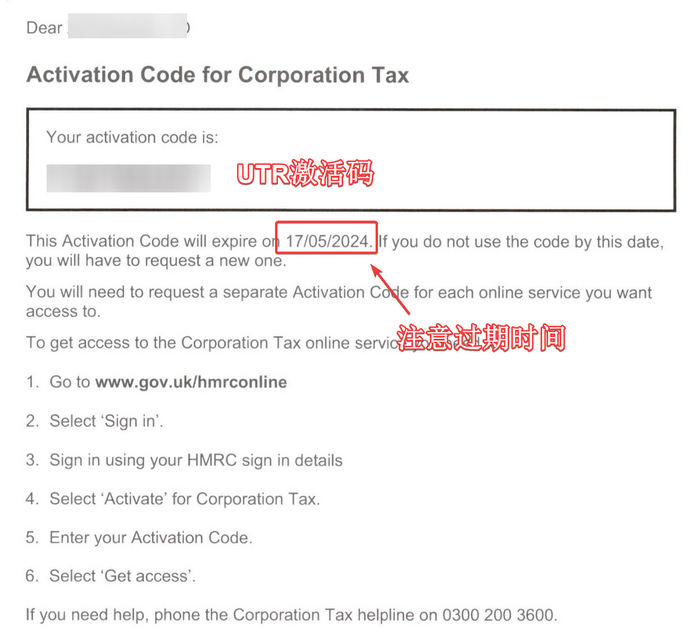

After applying for UTR registration, I received a notification from 1st a week later. Subsequently, 1st scanned the UTR activation code into a PDF and forwarded it to me.

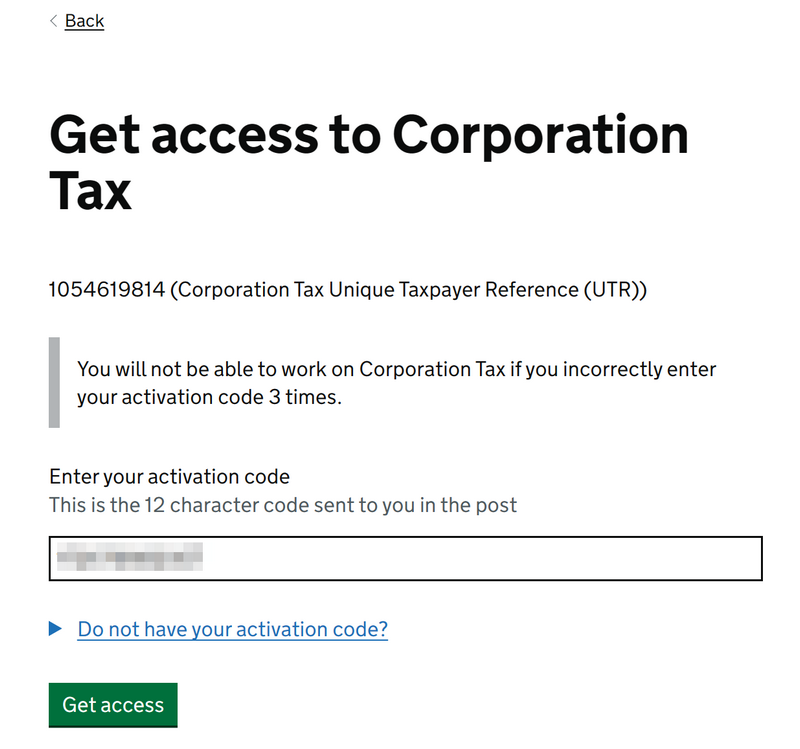

Enter the activation code; please note that the activation code has an expiration time. If activation is not completed within the specified time, you will need to reapply to receive a new activation code.

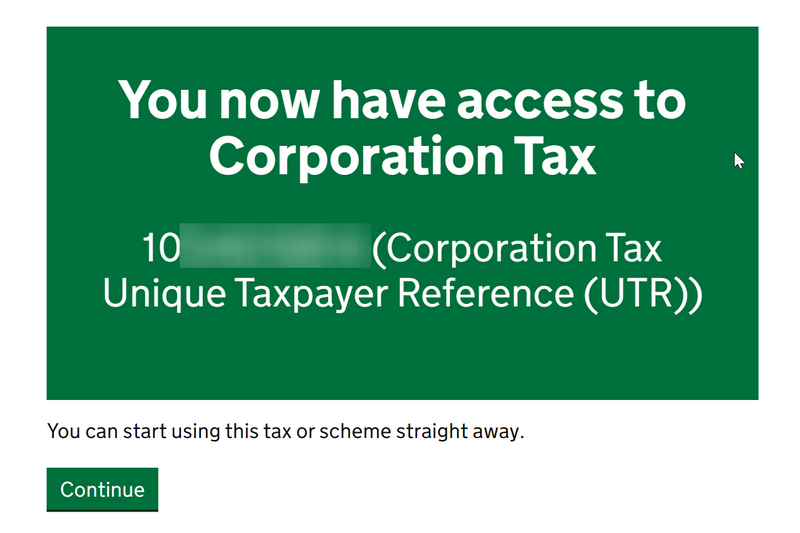

Complete the activation process.

Conclusion

For newly established companies, remember to complete the UTR registration within 3 months of commencing business activities! This step is crucial and affects the company's future tax handling. The steps and tips provided in this article are based on my personal understanding and experience, hoping to assist you. Of course, every company's situation is different, so if you find things complicated, consider consulting an accountant or tax advisor.

Additionally, I have created a freelancer exchange group. If you are interested, you can add my WeChat: xiaozme, and I will invite you to join.

The above content is original by xiaoz. Please indicate the source if you repost it!!!

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- Problem with the SSL CA cert error in WordPress

- Setting up Chinese and automatic association with Putty in WinSCP

- Baidu Netdisk Direct Download (Bypassing Large File Limit) Tips

- Optimize Your Website Images with TinyPNG

- Quick Start: Building the Ultimate Movie Watching Tool with Alist to Change Your Viewing Experience

- Which of these free SSH tools do you use?

- JD PLUS + iQIYI VIP Membership, Only 118.8 RMB/Year

- Guide to Opening a Bank Account in Hong Kong: South China Bank / Wing Lung Bank / Bank of China (Hong Kong)

- Compatibility Issue between Latest Version of Chrome Browser and Older Versions of jQuery

- Implementing Code Highlighting in WordPress Without Plugins