Industrial and Commercial Bank Shares Real Experience of Cross-border Remittance to Oversea-Chinese Banking Corporation (OCBC) in Singapore

Publish: 2023-08-10 | Modify: 2024-03-05

A few days ago, a netizen shared with me his experience of remitting money to OCBC Bank through ICBC, and the handling fee was reasonable. Therefore, I decided to reactivate my ICBC account and have successfully completed the remittance. Now, I would like to share my experience for reference by friends in need.

Preparation

- ICBC personal account

- ICBC APP

- OCBC Bank account: https://blog.xiaoz.org/archives/19012

RMB Exchange

After logging into the ICBC APP, search for "foreign exchange" on the homepage, then select "RMB exchange," and find "Singapore Dollar SGD."

Continue to select "RMB exchange for Singapore Dollar," then there is a "Personal Exchange Application Form," select "I have read and understood the above content." Then fill in the following information:

- Exchange amount: the amount of Singapore Dollars (SGD) you want to buy

- Exchange purpose, choose according to your own situation

- RMB payment account: you need to select your personal account, and ensure that the balance is sufficient (do not select the wrong one)

Then a confirmation message will pop up, just confirm if everything is correct, and the exchange will be successful.

Cross-border Remittance

After logging into the ICBC APP, search for "cross-border remittance" on the homepage, select "Remit to overseas banks," and you will be asked to fill in the recipient's information.

The receiving information for OCBC Bank in Singapore is as follows:

- Recipient's name: fill in pinyin, for example, if your name is Zhang San, then fill in "ZHANG SAN"

- Currency of the recipient: select "Singapore Dollar"

- Receiving country/region: Singapore

- SWIFT/BIC: OCBCSGSG

- Recipient's account: you can fill in your OCBC Bank's 360 Account/MSA/STS account (STS account is recommended for initial activation)

- Recipient's address: I directly filled in OCBC Bank's address: 63 Chulia Street #10-00, OCBC Centre East, Singapore 049514 (if special characters are not supported, remove the characters)

Follow the prompts for other information.

Estimated Time of Arrival

I initiated the remittance at 20:49 on 2023-08-08, and the arrival time was 2023-08-10 09:11, with the remittance arriving in less than 2 working days.

Remittance Handling Fee

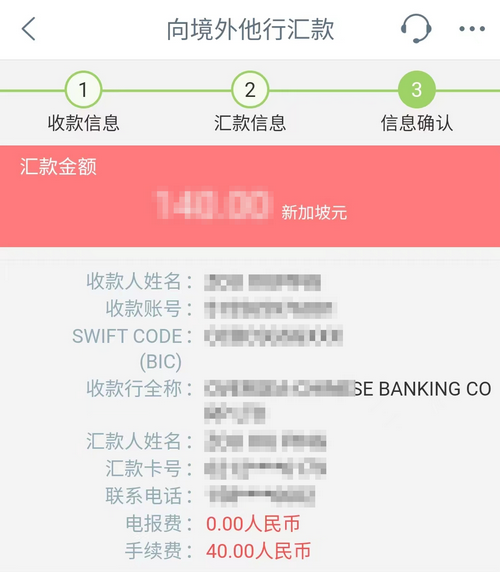

The ICBC APP clearly displays:

- Telegraphic fee: 0 yuan

- Handling fee: 40 yuan

In addition to this, there is a hidden intermediary fee that cannot be seen. I actually remitted 150 SGD, and received 142 SGD, with an 8 SGD deduction by the intermediary bank. Therefore, the actual remittance handling fee is: 40 yuan handling fee + 8 SGD (≈42 yuan) intermediary fee = 82 yuan.

In addition, a friend shared with me that when remitting 1100 SGD through ICBC, ICBC deducted a handling fee of 40 yuan, and OCBC received 1092 SGD. It seems that the intermediary bank charges a fixed fee of 8 SGD, so if the amount is too small, the remittance handling fee is not cheap. It is not recommended to remit small amounts, as the handling fee is not cost-effective.

Comparison between ICBC and Xiongmao Suhui

Introduction to registration and use of Xiongmao Suhui: https://blog.xiaoz.org/archives/19496

- On weekdays, the remittance to OCBC through Xiongmao Suhui arrives in a few minutes, faster than ICBC.

- I compared the exchange rates of Xiongmao Suhui and found them less favorable than ICBC.

- Xiongmao Suhui charges a handling fee of 80 yuan per transaction, which can be reduced with coupons, resulting in a similar handling fee. However, ICBC has a more friendly exchange rate.

- ICBC shows the remittance with the sender's name to OCBC, while Xiongmao Suhui does not. If the recipient bank has strict risk control, it is recommended to use ICBC, as it is a remittance with the same name and less likely to be scrutinized.

Notes

Some minor issues encountered during the remittance are summarized below.

Your current security authentication device has expired.

This may be because your account has a transaction limit, and the U Shield has also expired. Simply go to the ICBC APP "My - Security Center - Payment Limit" to increase the limit for "transfer remittance."

Insufficient balance in the debit account

This is because your RMB balance in ICBC is insufficient to deduct the handling fee, ensure that the account balance is sufficient.

Failed to purchase foreign exchange on iPhone

A friend reported that there was an extra personal account on his ICBC APP, which caused the purchase of foreign exchange to fail. The ultimate reason was that this friend had bound the ICBC debit card to Apple Pay, and Apple Pay generated a virtual account. When purchasing foreign exchange, he selected the virtual account by mistake. In this case, unbind the ICBC debit card from Apple Pay and make sure to select the correct account when purchasing foreign exchange.

Other Information

Currently, the blogger has only tested remitting SGD from ICBC to OCBC, which shows that it is an intra-name account deposit. Therefore, this method should be applicable for depositing money into WISE: https://blog.xiaoz.org/archives/18846

Discussion Group

I have also created a Telegram discussion group. If you have any questions, you can join the group for discussion: https://t.me/usecardone

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- 小z's Blog Officially Releases Msimple, a WordPress Theme for Personal Use

- Hong Kong ClubSim Mobile Card: Sharing Purchasing Experience and Usage Tips

- EchoTheme - A Minimalist Style Theme for Typecho

- Integrate ImgURL Image Hosting into Your Website

- Convenient Cloud Storage Management (Cloud-to-Cloud Transfer) Tool

- Methods for connecting to V-P-N on Windows 7

- DBeaver Connection to MySQL 8: Public Key Retrieval is not allowed

- A Code Snippet Management Tool Based on Github Gist: Lepton

- Webmaster Benefits: China's Wanwang Offers Free Virtual Hosting

- Tencent Cloud Spring Purchase Event: 2 Cores 2GB for 40 RMB/year, 2 Cores 4GB for 298 RMB/3 years