The Process of Freezing and Unfreezing Industrial and Commercial Bank Cards: My Experience Sharing

Publish: 2023-08-08 | Modify: 2024-01-10

Recently, an internet user told me that Industrial and Commercial Bank of China (ICBC) has relatively low fees for cross-border remittances (40 yuan per transaction, no telegraph fees). Therefore, I decided to use my ICBC debit card that has been idle for years. First, I downloaded the ICBC mobile app, but it prompted me to undergo identity verification. Considering that I haven't made any transactions with this card for over four years, this verification requirement is reasonable. So, I uploaded my ID card photo (I have replaced my ID card before it expired) and went through the facial recognition process smoothly.

Encountered Problem

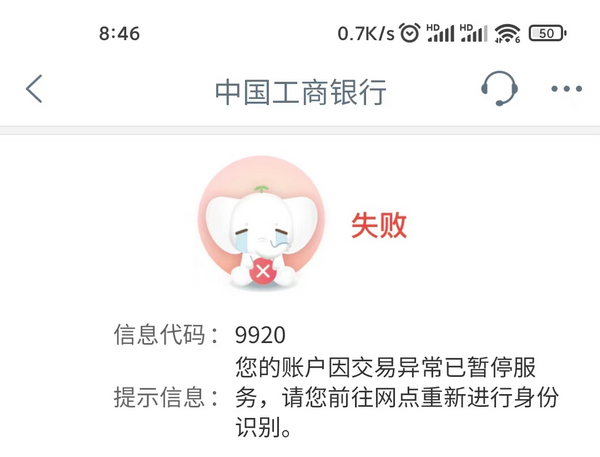

First, I used Alipay to withdraw 1000 yuan to my ICBC account, and the process went smoothly. However, when I was preparing to purchase foreign exchange, I received an error code (9920) with the following error message:

Your account has been temporarily suspended due to abnormal transactions. Please go to the branch to undergo identity verification again.

I continued to try transferring and recharging to Alipay, but both attempts failed. It can be determined that this bank card has been frozen. The phenomenon is that it can receive funds but cannot transfer out or perform non-counter operations.

Visiting the Branch to Resolve the Freeze

The next day, I found a nearby ICBC branch. The lobby manager asked me to fill out two forms:

- China ICBC Personal Settlement Account Opening and Usage Risk Warning Letter

- Account Verification Investigation Form

After taking a number, I waited for several hours until it was my turn. The teller seemed impatient and asked me two questions:

- Has it been a long time since you last used the card? I answered: Yes.

- This card hasn't been used for a long time. What is the purpose of reactivating it now? I answered: To deposit money.

The teller did not handle my issue but asked me to find the lobby manager to assist in unfreezing the card using the self-service machine. I sought the lobby manager's assistance again, but the attempt to unfreeze the card using the self-service machine failed. The lobby manager asked me to find a customer service representative at the counter. I returned to the counter and informed them that the self-service machine couldn't unfreeze the card. The teller rechecked my identity, requested my ID card and bank card, and processed the unfreezing procedure within a few minutes. This time, they didn't ask me any more questions and directly informed me that it was done.

Instead of leaving immediately, I continued to use the app to purchase foreign exchange and perform transfer operations. Everything went smoothly this time, and I was relieved that my account wasn't downgraded.

Conclusion: How to Avoid Similar Issues

I have a few thoughts and suggestions based on this experience:

- Regular usage: To avoid a bank card being frozen due to long periods of inactivity, it is best to conduct small transactions regularly to maintain an active account status. For example, link it to mobile payment platforms like UnionPay and Alipay and make regular small purchases.

- Update information promptly: If there are any changes to your identification information (such as obtaining a new ID card), update it promptly in the bank's system to avoid unnecessary trouble.

- Avoid transferring urgent funds to rarely used cards, as they may trigger risk control measures.

The above suggestions are for reference only. Each person's situation may vary, so if you encounter any issues, it is recommended to directly call the bank's customer service hotline or visit a bank branch for assistance. Have you ever had your bank card frozen? Feel free to share your experience in the comments.

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- Hide Backblaze B2 bucket paths with CloudFlare conversion rules

- Comparing TL-XDR5430 and Redmi AC2100 for AP purposes

- Zdir 4.1.3 Update: Added Multilingual Support for the Multifunctional File Sharing Program

- WordPress Site Map without Plugins

- Purchase Msimple Theme

- Explanation of Enabling WAF on Little Z's Blog

- Properly Handling Qiniu Cloud Image Acceleration to Avoid Website Ranking Downgrade

- What are some recommended cloud storage services after the closure of domestic cloud storage providers?

- Multi-platform SSH client Aechoterm (Flash Command), quickly connect SSH server, achieve multi-platform management

- Hostry Singapore VPS Review: 1 Core, 1GB RAM, $5/month, Unlimited Bandwidth