Guide to Closing a Statement Savings Account (SSA) with OCBC Bank Singapore

Publish: 2024-07-25 | Modify: 2024-07-25

xiaoz shared a detailed guide on opening an account with Oversea-Chinese Banking Corporation (OCBC) in the article "A Detailed Guide to Opening an Account with Oversea-Chinese Banking Corporation (OCBC) in Singapore". Hereafter referred to as OCBC, OCBC defaults to opening two accounts, namely SSA and GSA. SSA is a single-currency account in SGD, while GSA is a multi-currency account (excluding SGD), with SSA having higher maintenance fees.

About OCBC Account Maintenance Fees

- Statement Savings Account: First year free, subsequent years incurring a $10 SGD/month fee if balance falls below $20,000 SGD

- 360 Account: First year free, subsequent years incurring a $2 SGD/month fee if balance falls below $3,000 SGD

- MSA Account: First year free, subsequent years incurring a $2 SGD/month fee if balance falls below $500 SGD

- GSA Account: Currently understood to have no maintenance fees

Closing an SSA Account

The SSA account is free for the first year, and if the balance falls below $20,000 SGD, it is advisable to close it within 1 year to avoid incurring maintenance fees. Before closing, it is recommended to first open an MSA or 360 account; otherwise, you will not be able to receive or send SGD. This article shares xiaoz's personal account closure experience.

- Initially, I emailed OCBC APP to request closure of the SSA account, and the customer service advised to keep the SSA account at $0, and it would automatically close after 6 months. I followed the instructions.

- After 7 months, I noticed that my SSA account had not closed automatically, so I emailed customer service again to request closure.

- This time, customer service informed me that there was a $10 SGD maintenance fee due on the SSA account, which needed to be settled before closure.

- I tried to have customer service deduct $10 SGD from my 360 account for the SSA account maintenance fee but was rejected.

- Finally, after settling the $10 SGD maintenance fee on the SSA account, the account was closed.

From this, it can be felt that OCBC's customer service is not very professional, with different customer service representatives providing inconsistent information, so sometimes OCBC's responses may not be accurate!!!

OCBC SSA Account Closure Guide

- Before closing, it is recommended to first apply for an MSA or 360 account.

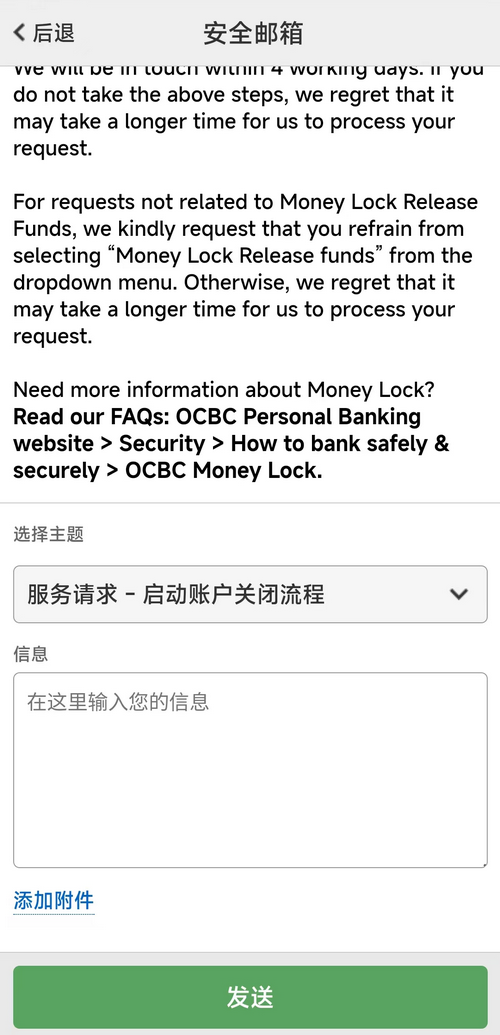

- In OCBC APP >> Open Secure Mailbox >> Choose the subject Service Request - Start Account Closure Process

- Request closure of the SSA account in English description and provide the SSA account number to avoid any mistakes by the customer service.

- If customer service advises you to keep the balance at $0 and wait for automatic closure after 6 months, you can ignore it and then continue to request closure of the SSA account after some time, which may result in a different customer service representative handling it.

- If your balance is below $20,000 SGD, it is recommended to close the SSA account within 1 year; otherwise, closure may require payment of account maintenance fees.

Below is a screenshot of the location of the secure mailbox:

Note:

- OCBC's secure mailbox usually takes 5 working days to respond, which is relatively slow.

- OCBC's secure mailbox function is not very good; sometimes you may not be able to submit due to special characters or excessive content. Pay attention to removing symbols and content.

Note: According to xiaoz's test, the 360 account will automatically close if the balance remains at $0 for 6 consecutive months, but the SSA account will not!!!

Conclusion

The above is the method to close an SSA account, which xiaoz personally tested. Before closing the SSA account, it is recommended to first apply for an MSA or 360 account; otherwise, you will not be able to manage SGD. Additionally, keeping the balance of the SSA account at $0 will not result in automatic closure after 6 months. Be sure to actively request closure to avoid potential maintenance fees.

If you have any other questions, feel free to leave a comment for discussion and to avoid pitfalls together.

TG Card Playing Exchange Group, welcome to join for discussions: https://t.me/usecardone

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- ProcessOn: A Free and User-friendly Mind Mapping/Flowchart Tool

- Open Source Directory Listing Program Zdir 3.1.1 Minor Version Update

- Using docsify to create a beautiful documentation system

- Installing Apache Bench on CentOS for Website Stress Testing

- Enable Gravatar Avatar Cache to Resolve Slow WordPress Loading

- Chat about the enterprise email service provided by Zoho Mail Lite

- CatCloud Domestic CDN, 30GB Free Monthly Traffic, Supports HTTP 2.0

- Useful Screenshot + Image Tool Snipaste

- 4 Methods to Change MySQL Root Password

- Using PDFObject to Preview PDF Files in Vue3