Opening an Account at iFAST Global Bank: Sharing the Experience and Offering GBP Banking Services

Publish: 2023-07-24 | Modify: 2024-01-10

iFast Global Bank is a licensed bank headquartered in the UK, dedicated to providing global banking services that connect customers, businesses, and financial institutions around the world. It is a subsidiary of iFAST Corporation and is fully regulated by the FCA, with coverage under the Financial Services Compensation Scheme (FSCS) up to £85,000.

Introduction

iFAST offers a UK IBAN account, which can be used for fund transfers and cross-border payments (for non-commercial purposes) and is available for Chinese users to apply. However, iFAST does not support virtual cards or physical debit cards, so its practicality is limited. If you do not have this specific need or are unfamiliar with its specific use, xiaoz does not recommend applying.

Applying for iFAST

Before applying, you will need to prepare the following:

- Chinese passport or identification card

- Commonly used email address

- Commonly used mobile number (domestic)

- Domestic bank statement (with address displayed)

iFast Global Bank application link: https://www.ifastgb.com/tellafriend/xiupingz6318

By registering through the invitation link above, depositing at least £500 and keeping the funds in the account for 3 months, you will receive an additional £5 as a bonus.

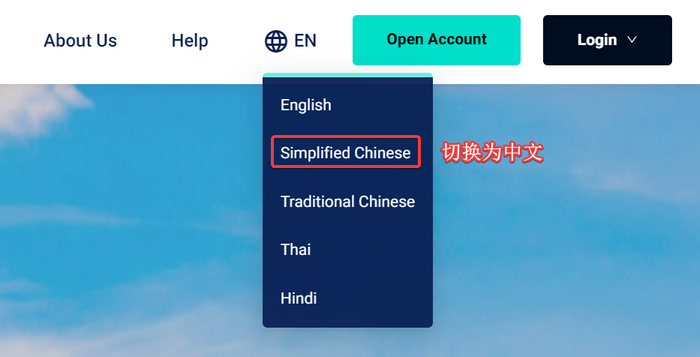

After opening the application link, click on the top right corner to switch to the Chinese interface, as shown in the following image.

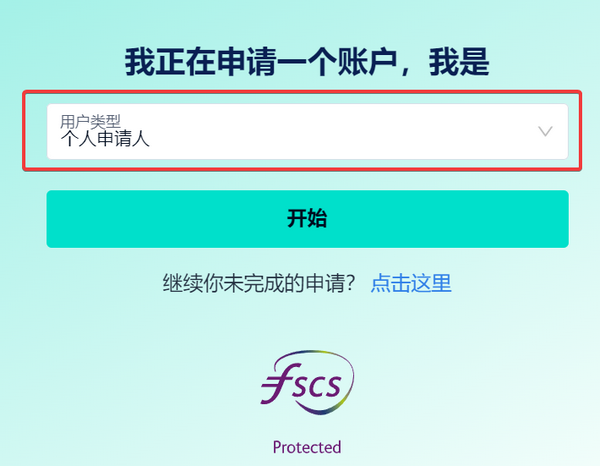

Select "Individual" as the user type.

The iFAST application requires a lot of information. Since xiaoz has already applied, it is not possible to provide detailed screenshots for each step. In summary, during the application process, fill in the information truthfully and pay attention to the following points:

- You will be asked to set a nickname and password, please remember them as they will be required for subsequent logins.

- I chose "Passport" as the document type and uploaded a photo of my passport. Some users have reported that selecting "ID card" is also acceptable.

- For address information, I provided my actual residential address in China and downloaded a PDF bank statement from China Merchants Bank as proof of address for iFAST. However, iFAST indicated that the format is not supported, so I uploaded a screenshot of the PDF instead.

- After submitting the information, you will be asked to schedule a video interview. Choose your available time (Beijing time) on the website for the appointment.

After a successful appointment, you will receive a notification email with the meeting ID and password. I verified the process in July 2023, and the video interview was conducted using the "Terms" software. You will need to prepare the following in advance:

- Passport

- Identification card

iFAST provides Chinese customer service. If you are concerned about the lack of Chinese customer service during the interview, you can use English to explain that your English proficiency is limited and request Chinese customer service support for the video conference (email sender: Digitalbooking@ifastgb.com). The following questions were asked during the meeting:

- Company name

- Job position

- Annual income

- Spelling of name

- Checked passport

- Checked identification card

- Inquired about current job start date

- Inquired about duration of residence at address

- Inquired about depositing funds from cryptocurrency platforms and informed that further proof may be required for cryptocurrency platform deposits

- Inquired about the country from which the first remittance is planned (United Kingdom)

- Inquired about the amount of the first deposit (around £5000)

- Inquired about the name of the bank from which the first remittance will be sent

- Inquired about date of birth

Each person's situation may vary, and some people may not be asked the above questions or may be asked other questions. As long as your information is truthful, answer truthfully.

Timeline

The timeline from "application - video interview - successful account opening" is as follows:

- July 16, 2023: Initiated account opening application on the website

- July 17, 2023: Scheduled a video interview

- July 24, 2023: Received notification of successful account opening

The entire process took about a week, which is relatively fast. However, some users have reported waiting for a month before successfully opening an account. In any case, if you pass the video interview, just wait patiently. It is considered normal to receive the result within one month.

Successful Account Opening

After a successful account opening, you will be provided with a UK IBAN number. This account supports multiple currencies by default, with GBP (British Pound) and CNY (Chinese Yuan) available. Additional currencies such as EUR, USD, SGD, and HKD can be added.

Clicking on the "Account Details" in the screenshot above will allow you to view the detailed information of your IBAN.

Depositing Funds to iFast via Wise

I tried depositing British pounds to iFast using Wise and initiated the transfer on a business day.

- 15:32: Initiated transfer

- 17:10: Wise sent for processing

- 17:31: Funds arrived in iFast

Please note that Wise does not process transfers immediately after initiation, and this process took about 2 hours.

Summary

- The application threshold for iFast Global Bank is not high, and it is currently possible to apply with genuine Chinese information.

- After submitting the information, you need to schedule a video interview. You can request Chinese customer service support in the email.

- After successful account opening, iFAST provides a UK IBAN account that supports multiple currencies.

- iFAST does not currently offer virtual cards or physical debit cards, so its practicality is limited.

- There are no annual fees or management fees for iFAST accounts, making them suitable as backup accounts.

Additionally, I have created a Telegram group for communication. If you have any questions, you can join the group for discussion: https://t.me/usecardone

Comments

xiaoz

I come from China and I am a freelancer. I specialize in Linux operations, PHP, Golang, and front-end development. I have developed open-source projects such as Zdir, ImgURL, CCAA, and OneNav.

Random article

- CatCloud Domestic CDN, 30GB Free Monthly Traffic, Supports HTTP 2.0

- Using Qiniu Cloud Storage to Host Images in Typecho without Plugins

- Deploying FRP Service on CentOS 7 to Achieve Intranet Penetration

- How to Install ImgURL Image Hosting on Baota Panel

- PHP Database Management Tool Adminer

- Open-source directory listing program Zdir 3.3.0 officially released, with added batch operations

- 4 Methods to Change MySQL Root Password

- nTrun: Quick Launch Tool in Win + R Mode

- My First Part-time Online Earning Experience

- Zdir Directory Listing Program Updated to v1.1